The Big Idea

We invest in entrepreneurs when they cross $1M, and we advise them toward $10M. We provide them with capital, partnerships, and advice while they grow beyond the first million. We partner with investors who can impact the brands we invest in with their network and their experience.

The Opportunity We See

Ecommerce valuations have plummeted since 2022. We see this as an opportunity.

There are also new platforms growing. We see this as an opportunity, too.

We have unique and strategic relationships to take advantage of this window of time, and we see that as the biggest opportunity.

The e-commerce market is undergoing a significant shift, marked by a reevaluation of business valuations and a recalibration of strategies. The heyday of high valuations fueled by abundant capital has waned, leaving behind a landscape characterized by lower valuations and reduced competition.

While traditional e-commerce models may have seen a decline in valuation multiples, there's a simultaneous rise in innovative approaches to brand-building. Platforms like TikTok Shop, Facebook Shop, and others are reshaping the landscape, emphasizing content and audience engagement. This shift aligns perfectly with our core model, centered on audience-centric brand development.

This current landscape offers a rare convergence of circumstances: lower valuations, evolving consumer behavior, and a hunger for innovative brand experiences. Investing in Capitalism Fund 2 means capitalizing on this moment of transition.

Our Process For Scaling Brands To $10M

Invest In Good Entrepreneurs

First step: find good deals. We have a homegrown pool of entrepreneurs, and we hand-select the best ones.

Provide Capital Support

Second step: Ensure that the business is properly capitalized. We offer access to equity capital, debt financing, or introductions to resources for maintaining inventory supply and reducing cash conversion cycles, ensuring the business has the financial backing to sustain rapid growth.

Introduce Strategic Relationships

Next, we plug the brand into our network of influencers, advisors, and other successful entrepreneurs. Our network (including our investors) goes to bat for our entrepreneurs.

Offer Infrastructure Support

Our relationship with SellerPlex allows brands to plug into proven systems and experienced personnel at below-market rates. This means the owner stays focused on high-level activities while we handle critical processes like inventory management, customer service, and platform performance.

Maintain Community

Along the way, we bring our investors and entrepreneurs together in person to foster collaboration between all stakeholders. We describe this as “the only mastermind where everyone is incentivized to have an exit together.”

Exit Strategy

Finally, we advise the entrepreneur as they prepare for exit. We may explore a rollup with multiple brands or coach each individual brand to receive the maximum valuation.

Meet The Team

Ryan Moran

Prior to founding Capitalism.com, Ryan built an e-commerce company from a $600 investment into an 8 figure exit 4 years later.

Since then he has spent his time pouring into his community of largely e-commerce based entrepreneurs to equip them with the tools necessary for exponential growth.

This has led to an engaged and loyal audience. Ryan's podcast and YouTube channel currently reach tens of thousands of entrepreneurs, giving him unique access to deal flow and strategic relationships.

Capitalism.com LLC

Samuel Prentice

He's been actively serving the Capitalism Community since 2016 and helped hundreds of entrepreneurs and investors keep more of the wealth they've created. In working with private clients and business owners, Samuel has developed a variety of strategic relationships for efficiently building and scaling businesses.

SellerPlex

Return Modeling

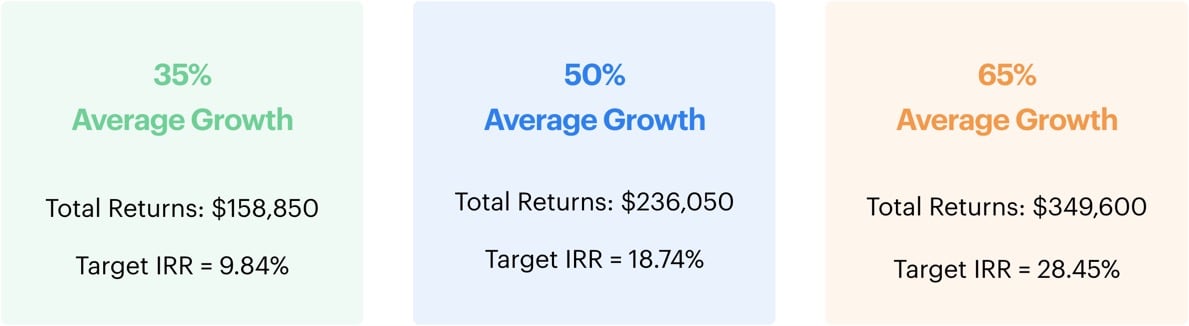

We believe that this offering provides are unique opportunity to passively invest in a diversified portfolio of e-commerce companies with significant upside potential.

Using *conservative projections, we modeled out the potential for returns based on a $100,000 investment.

Growth Numbers represent average year over year growth. Total returns are modeled based on the net to investor after GP expenses and split.

*Conservative Assumption are based on:

1.) A loss rate of 50% for all capital brought into the fund.

2.) A 5 year hold period with no distributions made prior.

3.) There is no factoring for an increase in business multiple at time of sale from the multiple we paid at acquisition.

Please Note: Actual returns will vary. You could lose some or all of your investment.

FAQs

Who is able to invest in this fund?

Any individuals, companies, or retirement account that qualifies as an accredited investor as defined in 17 CFR § 230.215 of the Securities act.

What is the profile of the target e-commerce business?

NEED

What are the biggest factors that drive the profitability of an e-commerce business holding?

As with any asset, the biggest factors are always supply and demand. As the long term trend of e-commerce sales continues to accelerate, we want to position ourselves to take advantage of the constantly fragmenting marketplace. Brands that are driven by strong entrepreneurs, are in a market that we believe has evergreen potential, and have good brand to consumer relationships are poised to take advantage of the overall buying trends in an exponential fashion.

How often will distributions be made to investors?

Can you discuss the risks of this investment?

As with any private investment in the e-commerce sector, this investment should be considered risky, with the possibility that you could lose some or all of your money. Before considering an investment, you should review carefully the risks outlined on this page as well as the risks disclosed in our Investor Disclosure Document.

What is the minimum investment for individuals and IRAs?

The minimum investment for both individuals and IRA’s will be $100,000. We are expecting to raise approximately $5,000,000 for this offering.

What makes this offering different from other offerings?

We believe there is significant upside potential in this specific offering. This is an incredibly unique offering where a fund partner has access to preferentially advantaged deal flow in an asset class that inherently has significant upside potential. By buying at the optimal time, we are able to participate in the most drastic growth times of these developing companies, and take advantage of the increased sale multiple at time of exit.