Pharmaceutical and drug retailer stocks are hot right now. The battle of CVS vs. Walgreens is even hotter.

Whether because of an aging population or pharmaceutical advancements, no portfolio is complete without them. Investors are weighing CVS vs. Walgreens as their next buy. But does either one pass our strict dividend investing criteria?

Disclaimer

Before we begin, you need to know that we’re just people on the internet who have fun playing with stocks. Investing in stocks is risky. Nobody here at Capitalism.com is an investing expert. This information is for entertainment purposes only. You should definitely consult a qualified investment advisor rather than relying on this discussion to make important decisions.

In this post, we’re going to look at two seemingly similar companies, CVS and Walgreens, and apply our dividend investing criteria to compare their stocks.

Most of America shops for their prescriptions, toiletries, and even the occasional snack at either one or the other. So, you might say, “Just invest in your favorite,” but that may not be the best way to pick a stock. When it all comes down to details, Walgreens and CVS are very different companies.

CVS is a part of the healthcare industry, and more particularly, in the pharmaceuticals sector. On the other hand, Walgreens is a consumer staples stock in the drug retailers sector.

But which one of these companies’ stocks passes all of our dividend investing criteria?

The Boring Investment Strategy that’s Perfect for Entrepreneurs

Before we get into the analysis, you should know this investment strategy has the potential to change your financial future long-term. It’s especially attractive to busy entrepreneurs who already have enough risk to deal with via the business they’re building. Find out why.

But dividend investing isn’t particularly sexy until you understand it. In fact, part of its appeal is how “boring” and “predictable” it is. While other stock investors are alternately jumping up and down or screaming at their computer screens, depending on how the market did that day, you’re just quietly amassing a fortune. No drama.

When in doubt, remember this: “It’s not about predicting what’s going to happen. It’s about buying stocks on sale.”

Now that we’ve cleared that up, let’s review our criteria for buying stocks with dividend investing in mind.

The criteria for buying dividend stocks are these:

- The company has raised its dividend every year for the past 10 years or more.

- Only buy stocks with a 3.5% to 4% dividend yield.

- Only buy stocks when their price falls due to “bad news.”

- Only buy stocks in profitable companies, so you know they’ll keep paying dividends.

Let’s take each of these one-by-one.

Rule #1: The company has raised its dividend every year for the past 10 years or more.

We’re looking for companies that reliably pay out dividends, regardless of market conditions. If a company has and continues to raise its dividends, it makes it unlikely they’ll stop paying dividends.

CVS has not raised its dividend since December 2016. Then, it increased its dividend from $0.4250 to $0.50 per share, where it has remained.

On the other hand, Walgreens has increased its dividend for 44 consecutive years. In fact, Walgreens just declared a quarterly dividend on Friday, January 29th. On Friday, February 19th, shareholders of record will receive a dividend of 0.4675 per share by the pharmacy operator on Friday, March 12th. This represents a $1.87 dividend on an annualized basis and a yield of 3.72%.

Thanks to raising its dividend so consistently, WBA is a member of the exclusive Dividend Aristocrats. To be a Dividend Aristocrat, the company must have increased its dividend for at least 25 consecutive years. CVS vs. Walgreens, Advantage: Walgreens.

Rule #2: The company currently pays out between 3.5% to 4% in dividend yield.

The dividend yield is the dividend paid out divided by the current price of the stock. The dividend yield can increase only in two ways: if the dividend increases or the stock price decreases.

As most of the stocks we’re looking at with this method will increase their dividends over time, it’s most likely their dividend yields will increase when their stock price takes a hit.

That can be for many reasons. Market conditions can deteriorate, or its sector can fall out of favor. It’s perhaps had a company-specific problem such as a drug not getting FDA approval or suffering an oil spill.

Right now, CVS’s dividend yield is a miserly 2.78%, while Walgreens is 3.72%. In the next section, we’ll see the stock price movement leading to the disparity in yields. CVS vs. Walgreens, Advantage: Walgreens.

Rule #3: The stock price fell due to bad news.

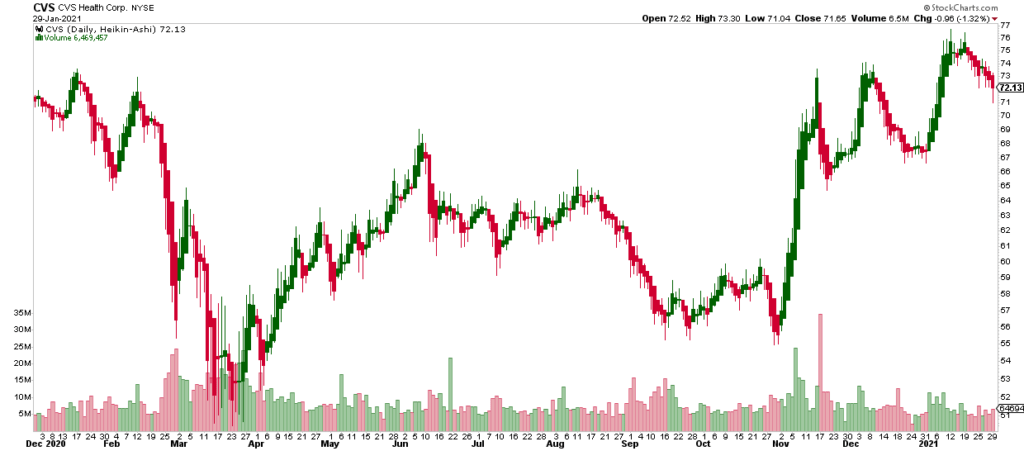

Both stocks fell precipitously, along with every other stock in March 2020. But as you can see, they recovered like almost every stock since then.

But CVS bounced back much better initially, while Walgreens kept getting hammered. This is why CVS’s dividend yield is much lower than Walgreens’. From this perspective, that’s what makes Walgreens a better buy. It’s a much cheaper stock, which drove its dividend yield up.

Though we’re not looking at this through a capital gains lens, it’s worth noting Walgreens may have more upside than CVS. CVS vs. Walgreens, Advantage: Tie.

Rule #4: The company is profitable.

Back in 2018, CVS Health had significant challenges with its long-term care pharmacy business and had also absorbed Aetna, the managed healthcare company. It didn’t cut its dividend that year but staggered under a full-year loss.

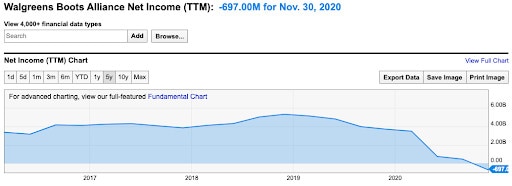

Walgreens had a massive problem with its UK stores in 2020 due to the coronavirus lockdown. This led to a loss of $697m for the trailing 12 months. (That’s what the TTM stands for.) The UK government has virtually closed down the country for the past year, even though pharmacies were deemed essential businesses. The ticker for Walgreens, WBA, is an acronym for Walgreens Boots Alliance; Boots is the UK’s major pharmacy.

Walgreens soothed investors by setting a cost-cutting target of over $2 billion.

So though they’ve both had a rough time within the last few years, Walgreens’ difficulties are more recent. As the UK government signaled it’s not lifting the lockdown perhaps until spring, this doesn’t bode well for Walgreens. CVS vs. Walgreens, Advantage: CVS.

CVS vs. Walgreens: Let’s Review the Results

| Criteria | CVS | WBA |

| Raised its dividend for each of the past 10 years | No | Yes |

| Paying out a 3.5% - 4% dividend yield | No, 2.78% | Yes, 3.7% |

| Price fell due to bad news. | Yes | Yes |

| The company is profitable. | Yes | No |

Based on this criteria in the battle of CVS vs. Walgreens, WBA is the winner, 3-2.

Of course, before you make your final decision, it’s essential to make sure WBA regains its profitability quickly and keeps paying that dividend. The January 29, 2021 announcement that WBA will pay its dividend is a good sign. If WBA raises its dividend again this year, that’s an even better sign that its management thinks it’s out of the woods.

The Takeaway

In this post, we looked at two similar companies that are part and parcel of most Americans’ lives. Using four simple criteria to evaluate which one is a preferred buy makes this method easy to use. And reuse. Over and over again.

Just a quick note. Non-US investors need to talk with their financial advisors about the implications of withholding tax on their dividends. That is, this strategy may give your smaller returns than you expect. Make sure you speak with an experienced tax expert in your country about this.

And finally, remember this rather odd take on the markets. It will help you keep your head when the inevitable sell-off arrives:

“Bad news (for your stock’s price) may be good news (for your stock’s dividend yield).”

About the Author

Sean Ring, CAIA, CMT, FRM contributed this article. Sean is the CEO of Finlingo.com, a fintech company that creates limitless practice questions for financial examinations. He has over 25 years of banking and training experience. In 2020 alone, he’s trained the new hires of the Abu Dhabi Investment Authority, Bank of America, Goldman Sachs, DBS, and Standard Chartered.