The operations and decisions by Federal Reserve’s Board of Governors often seem detached from small business daily operations. Though large corporations have a lot to gain or lose based on the decisions of the Federal Open Market Committee (FOMC), small businesses can still be greatly affected.

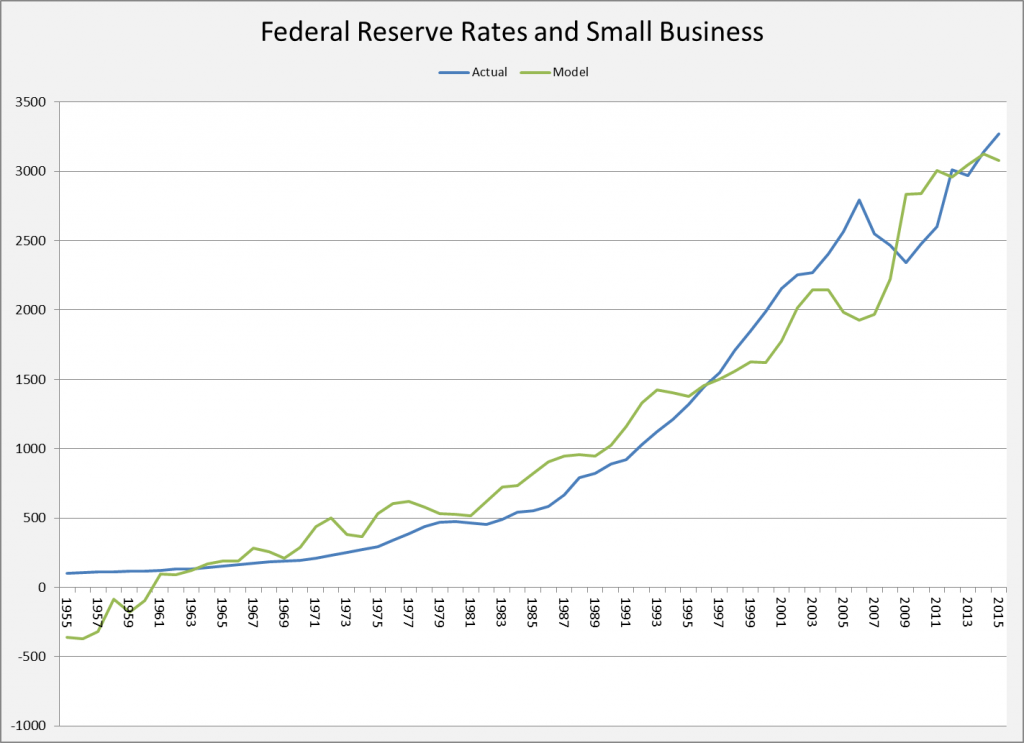

To demonstrate, this hedonic model shows how sole proprietorship income from 1955 to 2015 is affected by the effective federal funds rate, consumer price index (CPI) and population. All these data series were gathered from the Federal Reserve Database (FRED). Below is a chart of the model.

(Note: The variables, excluding CPI, are statistical significant. The CPI not being a significant influencer makes sense as the diversity of small business means they can adjust prices to account for inflation.)

This model shows us that as federal funds rates rise, we see a decrease in small business income. But why?

There are a few reasons why the federal funds rate affects the income of small business. The most important involves consumption.

When rates increase the return on invested money also increases, which creates a disincentive to consume. This reduction in consumption means people are less likely to engage in any purchasing across the economy.

The increasing of the federal funds rate also partly blurs the market equilibrium of savings and lending. If the rate at which funds accrue value increases, then there should be more people willing to deposit funds.

Subsequently, this means there should be more funds to lend, which mitigates scarcity of funds. A decrease is scarcity has the same effect as an increase in supply.

As supply rises, we should expect the cost to borrow money to fall; though we don’t see this in practice. This is because the Federal Reserve is both setting the rules of the game and playing in it.

By creating a baseline interest rate (federal funds rate), the market cannot not expand and contract to a true equilibrium. This is both good and bad.

This is good because it eases bubbles and provides a stable floor savings that are needed for growth, according to the most widely accepted economic growth model, Solow Growth.

It is bad because it can cause a phenomenon called “crowding out,” this is when there are not enough funds to satisfy the demands of all the entities that want to borrow. This results in increasing interest rates that combine for a dual edge sword of pain to small businesses: reduction of consumption (as outlined above) and increased expansion costs.

Though this phenomenon is only in the short run, eventually (at most 12 quarters) an increase in deposits will cause a fall in interest rates which should incentivize consumption.

We already discussed the variables around reduction of consumption, the long term deflators to small business come in the form of increased expansion costs driven primarily by increasing interest rates from crowding out.

If small business wishes to expand during a period of rate hikes, they may bond the expansion at a much higher rate than the period right before the rate hike. An increase to the cost of capital is always one of the most sensitive inputs to any considerations of expansion.

While there are certainly downsides to when the Federal Reserve increases rates, the reduction in volatility the Federal Reserve provides is a silver lining to small business. Small business tends to be more sensitive than larger businesses to changes in policy and economic positions; the Federal Reserve allows for monetary changes to take place slowly and over a greater period of time than traditional legislative processes would allow.

This ability to gradually introduce change over an elongated period of time in, small and purposeful, steps means small businesses are less likely to deal with a radical change at once. Additionally, the Federal Reserve Board of Governors makes its decision based upon up to date economic indicators, which means they are not tied to decisions made on old or bad data.

The logical question after all this framing is what a small business should do, regarding rates.

First is to keep up to date with the latest news. The Federal Reserve rarely makes a surprising rate change. In fact, they tend to be very cautious of ensuring their intentions are known months ahead of a vote.

They may not directly say if rates are going to change or not, rather they will speak about what economic indicators should be in order for them to approve a change. If these indicators match the Reserve’s expectations, then a rate change should be expected.

Maintaining strong relationships with multiple banks is a great way to lessen the effects of interest changes on future lending needs. While having strong a relationship with a primary bank can be a strong asset for a small business’ day to day operations, multi relationships with lending firms can prove to be a cost saver after a rate increase.

While these tips may help ease any apprehensions one might have of rate changes, in a more global sense it is important to remember that in the long run, the market will correct back to a general equilibrium. While a small business may feel pain in the short run, which is a very real concern, after the initial rate change the market is surprisingly quick to adjust. Crowding out and consumption reduction will begin to fade within a few quarters, along with potential asset bubbles.

The single best way for a small business to deal with rate changes to keep up to date with the news coming from the Federal Reserve, and planning early for the changes.

LEARN MORE ABOUT FINANCE ON CAPITALISM.COM

• 3 Key Steps to Strengthen a Business Loan Application

• How to Properly Use Debt to Build Wealth

• Business Basics: How to Build – and Understand – a Profit-Loss Statement