Monopolies are the product of government regulation and intervention.

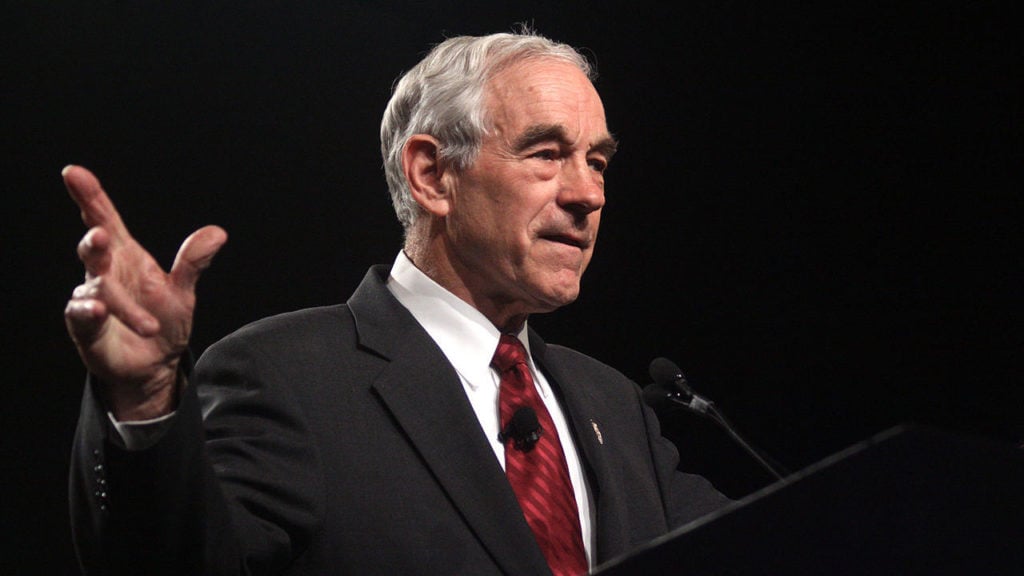

That's what former libertarian Republican presidential hopeful and 12-term Congressman Ron Paul argues in a 2016 nationally syndicated op-ed published by USA Today. Paul explains that government control in industries that are heavily regulated is a direct cause for market share monopolization.

“Monopolies and cartels are creations of government, not markets,” Paul wrote. “For example, the reason the media is dominated by a few large companies is that no one can operate a television or radio station unless they obtain federal approval and pay federal licensing fees.”

A Tool To Limit Competition

Simply, the government’s controls on regulation and pricing are used to limit competition. In one regard, licensing rules and certain consumer protection laws can prevent market entry.

For example, according to Paul, taxes, and rule-making on specific industries can carve out spaces for monopolies to grow since smaller players would be forced to deal with rising costs of operation—or even closure. This advantage of size gives larger corporations the ability to dictate the outcomes of policy, as well.

Large companies create the trade groups for the industry. They also fund lobbying and advocacy efforts, purportedly, on behalf of the whole industry also. So, these regulations are direct products of the influence of the major corporate interests.

Needless to say that running a business isn’t a crime, no matter the size; however, the takeaway should be that certain laws—even agencies—can be swayed by the justifiable lobbying efforts of large funders.

Real World Examples

Take the interactions the private sector has with agencies like the Food & Drug Administration (FDA). FDA's approval and testing processes on even the safest of generic medication drive the cost of drugs through the roof. When smaller companies who produce biosimilar or generic versions of name-brand drugs, the courts and the FDA are more likely to side with the larger company that has created the original drug almost exclusively.

The EpiPen price crisis was all because of regulators in-action in approving biosimilar or generic-similar to the drug. EpiPen manufacturer Mylan was able to corner the global marketplace by being the only company producing mainstream EpiPen treatments.

On Wall Street, large financial institutions were able to leverage the Dodd-Frank legislation to benefit their bottom lines by targeting smaller, far weaker competitors.

Also, consider why there are so few competitors in the cable industry. No, it wasn’t big cable’s corporate power. It was big cable’s corporate power complimented by the force of law to limit market entry for smaller, more affordable competitors.

Government backed monopolies pose risks to the market, as well. When state owned enterprises are modeled to be the sole "service" for a region or country, imitators in the private sector are either tightly regulated or stamped out entirely. Entities like the U.S. Postal Service vertically and horizontally control the area of the economy in which they operate.

Free Markets, Pure Competition

“Any businesses that charge high prices or offer substandard products will soon face competition from businesses offering consumers lower prices and/or higher quality,” Paul wrote further. “Monopolies only exist when government tilts the playing field in favor of well-connected crony capitalists.”

Or in other words, a free market economy can’t operate under the parameters of government and business controlling the state of competition, innovation, and product delivery.

What do you think? Tell us in the comments below.

MORE POLICY ANALYSIS ON CAPITALISM.COM:

• Illinois Lawmakers Think $5 Billion Tax Won’t Drive Residents To Tax Friendly States

• Minneapolis Businesses Brace For Minimum Wage Hikes

• Dairy Pride Act Is Protectionist Government Intrusion In Declining ‘Milk’ Industry