August marked the largest increase in health costs in a single month since the year 1984. Insurance premiums, doctor fees, medicine prices, etc. are all rising dramatically and with no end in sight. So much for Obama providing affordable healthcare.

CNN reported "Kaiser/HRET Employer Health Benefits forecasts that the average family health care plan will cost $18,142, up 3.4% from 2015."

Despite the claims from Obamacare supporters that Americans would, as a result of these regulations, see a reduction in these costs, the opposite has been the result. And this is relatively undisputed, despite the many partisan progressives who continue to remind us just how many more people have health coverage today than before.

So is this our new normal? Should we just expect precipitously rising health costs? Is that the price of providing health coverage to a nation? Well, it certainly doesn’t have to be, and competitive pricing is one area where we can greatly reduce the unnecessarily high costs of health care.

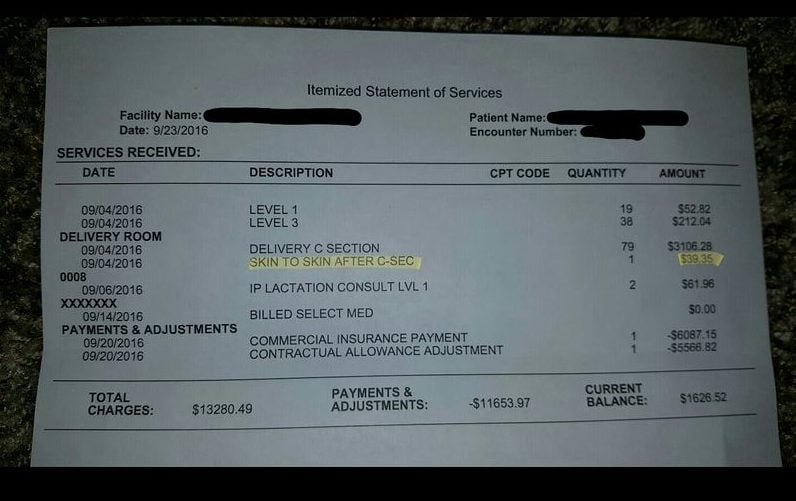

A recent story has been circulating the news media in the past few weeks about a young couple who recently had a baby and received a hospital bill that included a $39.35 charge for “Skin to Skin after C-Sec” (Cesarean Section). Seems absurd right, that the hospital would charge for something so ridiculous as holding your baby against your chest? Apparently, the father wanted a moment with the child and the mother right after delivery, and the hospital felt the need to charge them for that moment.

The problem, in this case, wasn’t so much that the hospital would charge for skin-to-skin “care” – as absurd as the charge is – rather, that the couple had no idea that they could be charged for it beforehand.

A study published by The Journal of the American Medical Association (JAMA) from in 2014, conducted by Jillian and Joseph Bernstein, showed that Americans are more likely to track down the cost of hospital parking rather than finding out the price of a common medical procedure at that same hospital.

Talk about absurdity.

Unlike virtually any other industry in America, the health industry completely removes the consumer from the pricing process altogether. If you belong to an HMO, odds are you can’t even get an itemized list of charges before a medical procedure. You’ll instead receive a bill in the mail some months after the procedure and then have an opportunity to contest the charges at that time. And it doesn’t get much better with PPOs and other private practices. If the consumer wants information on pricing, he is often told to simply contact his insurance company to receive information about his deductible and out-of-pocket costs.

You may have heard the analogy before, but health care, in many ways, is similar to maintenance on a vehicle. From time to time, you need to bring in your car for a tune-up just like you need to get a physical every so often. Most only see a doctor when they are sick, just like most only go to a mechanic when there is something wrong with their car. There are many at-home treatments one can use to maintain their health, just like changing your oil, or replacing your brake pads are at-home treatments for your vehicle. You have to have insurance for both. The list goes on and on, right?

Well, in 2006, the average annual cost to maintain a vehicle was $926.80, and in 2016, that number increased to $1039.34. After adjusting for inflation, however, the average consumer spends about 6.5 percent less to maintain his car today than in 2006, despite all the technological advancements and new gadgets that can break on vehicles today. But, according to the Milliman Medical Index, the average annual medical costs for a family of four was $13,382 in 2006. In 2016, that amount has risen to $25,826. After adjusting for inflation, we find that health care costs have risen 61 percent since 2006.

Now ask yourself these questions. Have you ever gone to a mechanic that wouldn’t provide you with a quote before working on your vehicle? Have you ever gone to an auto parts store and was forced to pay for a product before first knowing what the cost of that product was? Have you ever gone to get your tires replaced, paid only a small deductible and received a bill in the mail a month later with all sorts of extra charges that you felt were completely unnecessary? Odds are you haven’t because these are not common practices in the auto industry – or any other industry for that matter.

So, why should we accept such ridiculous behavior in the medical industry? Johnny Harris from Vox put it best when he said, “consumers are totally divorced from prices” in the health care industry and a “lack of transparency can lead to an artificial inflation of prices, making consumers pay more for treatment that is of no better quality.” And are we not experiencing that right now? Have we not been experiencing a general rise in prices with a reduction in quality?

The consumer is the most vital component of any industry. It’s consumers, collectively, who decide what products are good, what products are bad, what companies prosper, what companies fail, etc., etc. Through their ability to, as Milton Friedman used to say, vote with their feet, consumers wield a great deal of power in the marketplace. But the government has removed the consumer from the pricing process, and instead replaced the consumer with intermediaries that don't necessarily have an interest in lower prices or better care.

And when you couple that with burdensome regulations like Certificate of Need (CON) legislation that purposefully limits the number of hospitals and doctors that can operate in a given jurisdiction under the completely backward assumption that an excess of supply leads to inflation, it’s no wonder why costs only tend to increase. There’s no irony lost in that acronym by the way. The concept that a glut of hospitals and doctors would force an increase in health costs because of "empty beds" defies every law of supply and demand. The reality is that hospitals and physicians would reduce their size and capacity based on demand, and further specialize their practices just like any other industry.

But there is hope. The Surgery Center of Oklahoma prides itself on being the “Free market-loving, price-displaying, state-of-the-art, AAAHC accredited, doctor owned, multispecialty surgical facility in central OK.” That’s right, they have built into their website a comprehensive list of all the types of operations that they perform and the price for each procedure. They even have a “Pricing Disclaimer” visible on their website advising their patients of additional charges so as to maintain their goal for, “the price to be as transparent as possible.” I bet that couple charged for skin-to-skin would’ve appreciated such a pricing disclaimer.

And this is precisely why competitive pricing matters. If hospitals and health practitioners were forced to compete with one another, they would have to be more transparent with their prices. This would, in turn, drive prices downward and improve quality in health services as consumers would begin matching their needs based upon the price they can afford, and the quality of the doctor. The consumers would hold the majority of the power in the market as is intended in a market economy.

There is no reason why consumers should be left in the dark about the cost of their care. Efforts made to separate the consumer from pricing has clearly created perverse incentives for insurance companies and hospitals to set prices higher than what the consumer would otherwise agree to beforehand. It's time we recognize that the government’s attempt to cartel-ize the health industry into a few large insurance companies that fix prices with hospitals is a massive failure.

What we need are freer markets where consumers can actively participate and choose what procedures they pay for, rather than funneling every transaction through an insurance company. Only by empowering the consumer will we see prices fall to desirable levels.