This past month has been a whirlwind. If you're like most entrepreneurs, you felt the excitement of a new opportunity mixed in with a whole bunch of anxiety about the future. The result of the coronavirus is yet to be seen.

Meanwhile, the United States Congress passed a $2 trillion stimulus plan and COVID-19 Tax Relief package that has some good in it, and some not so good in it. We’re all still learning about what is in this bill. So, there is still a lot of interpretation to do.

First, Is It Okay to Take COVID-19 Tax Relief or CARES Act Money?

We asked Capitalism.com founder, Ryan Daniel Moran, about his take on this. Here’s what he said:

“Now, I don't particularly like it when the government gets involved in business. I don't like the government meddling in my business. I don't want the government meddling in other people's businesses, either.

But when the government gives your business free money, you take it. When the government stacks the system in your favor, you use it.

There is nothing beneficial about refusing what the system provides for you. After all, the system is providing the same things to lots of other people. So, there is no award for not using the system. There IS an award for serving customers, being profitable, and using every advantage you can take to do that well.

If my interpretation of the bill is correct (and my advisor team tells me that this is indeed more like a grant, not a loan), you better believe that I will take advantage of it. It's just like when I took advantage of scholarships and student loans when I went to college. There is no award for not taking loans or not taking scholarships.

My take on the stimulus plan that passed is that I'd prefer the government just stay out of the way. At the same time, if the government broke the nation's business arm, the government is kind of responsible for paying for the cast for the arm to heal. I wish the government had never broken the arm in the first place, but since they did, it does make sense for us to take advantage of what they are now providing.

That money is going to go somewhere. Politicians will utterly waste it, so they might as well waste it on us.”

COVID-19 Resource Roundup

As an entrepreneur, you probably have more questions than answers. You may even be wrestling with the idea of taking a COVID-19 tax relief or stimulus package check. That’s why we’d like to share some resources that may be helpful.

The Coronavirus Stimulus Package and CARES Act

The simplest explanation is that these bits of legislation aim to help individuals and business owners stay afloat during the challenges we’re facing.

Coronavirus Stimulus Checks (For individuals)

Your 2020 Stimulus Check: How Much? When? And Other Questions Answered

This article answers many of the questions you may have, including:

- How many stimulus checks will I get?

- How much money will i get?

- If I haven't filed my 2019 return yet, should I do that now or wait?

- If I wait to file my 2019 return to get a bigger check, will I have to pay back the difference later?

- What if I didn't file a tax return in 2018 or 2019?

- Will lower-income people get smaller checks?

- When will I get my check?

- Will the money I get now be taxed later?

- What if I had a child in 2019, but I haven't filed my 2019 return yet?

- What if my child turned 17 in 2019, but I haven't filed my 2019 return yet?

- Will young adults who live with their parents get a check?

- Will "nonresident aliens" get a check?

- Do I have to have a Social Security number to get a check?

- Will the IRS take my check if I owe back taxes?

- What if my check doesn't arrive?

Stimulus Check Calculator

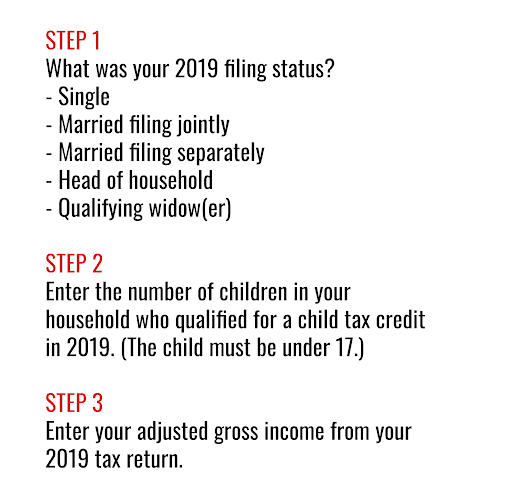

Here is a great calculator regarding the stimulus Payments and what it potentially could look like for your family. Use information from your 2019 tax return if you have already filed it. If you have not yet filed your 2019 return, use information from your 2018 return.

What the IRS Says

You’ve probably already heard that the filing and payment deadline for federal income taxes has been extended to July 15, 2020.

But you may have more questions about Coronavirus Tax Relief and Stimulus Payment Checks. The IRS has established a special section focused on steps to help taxpayers, businesses and others affected by the coronavirus. This page will be updated as new information is available. You might want to bookmark this link to get updates as they happen.

CARES Act (COVID-19 Tax Relief or small business owners)

The programs and initiatives in the Coronavirus Aid, Relief, and Economic Security (CARES) Act that was just passed by Congress are intended to assist business owners with whatever needs they have right now. When implemented, there will be many new resources available for small businesses, as well as certain non- profits and other employers. This guide provides information about the major programs and initiatives that will soon be available from the Small Business Administration (SBA) to address these needs, as well as some additional tax provisions that are outside the scope of SBA.

To keep up to date on when these programs become available, please stay in contact with your local Small Business Administration (SBA) District Office, which you can locate here.

Struggling to get started? The following questions might help point you in the right direction. Do you need:

- Capital to cover the cost of retaining employees? Then the Paycheck Protection Program might be right for you.

- A quick infusion of a smaller amount of cash to cover you right now? You might want to look into an Emergency Economic Injury Grant.

- To ease your fears about keeping up with payments on your current or potential SBA loan? The Small Business Debt Relief Program could help.

- Just some quality, free counseling to help you navigate this uncertain economic time? The resource partners might be your best bet.

No Crystal Ball, But Here’s Ryan’s Prediction

“Moving forward, I expect that things are going to stabilize. There's still going to be a lot of uncertainty. As entrepreneurs, here's our job:

- To rise up as leaders.

- To lead our teams.

- To lead our families.

- To lead our customers.

- To lead our followers.

As investors, our job is to buy good companies at good prices that pay healthy dividends or have healthy balance sheets.

These are our prerequisites for making decisions. When the government decides to incentivize something, pay attention to it.

It's okay for you to take free money. It's okay for you to make smart decisions. It's okay for you to make strategic investments at the right time.

It's never okay to take advantage of the system for your own personal gain. What is okay? For you to prosper as you serve others - and that's the point of all of this.”

Inside The One Percent Community, entrepreneurs just like you have conversations and share resources every single day. While entrepreneurship can feel really lonely, it sure doesn't have to be like that. Especially during troubling times, it's good to have like-minded business owners you can check in with. You don't have to go it alone. Why not take a look and see if The One Percent is a fit for you?