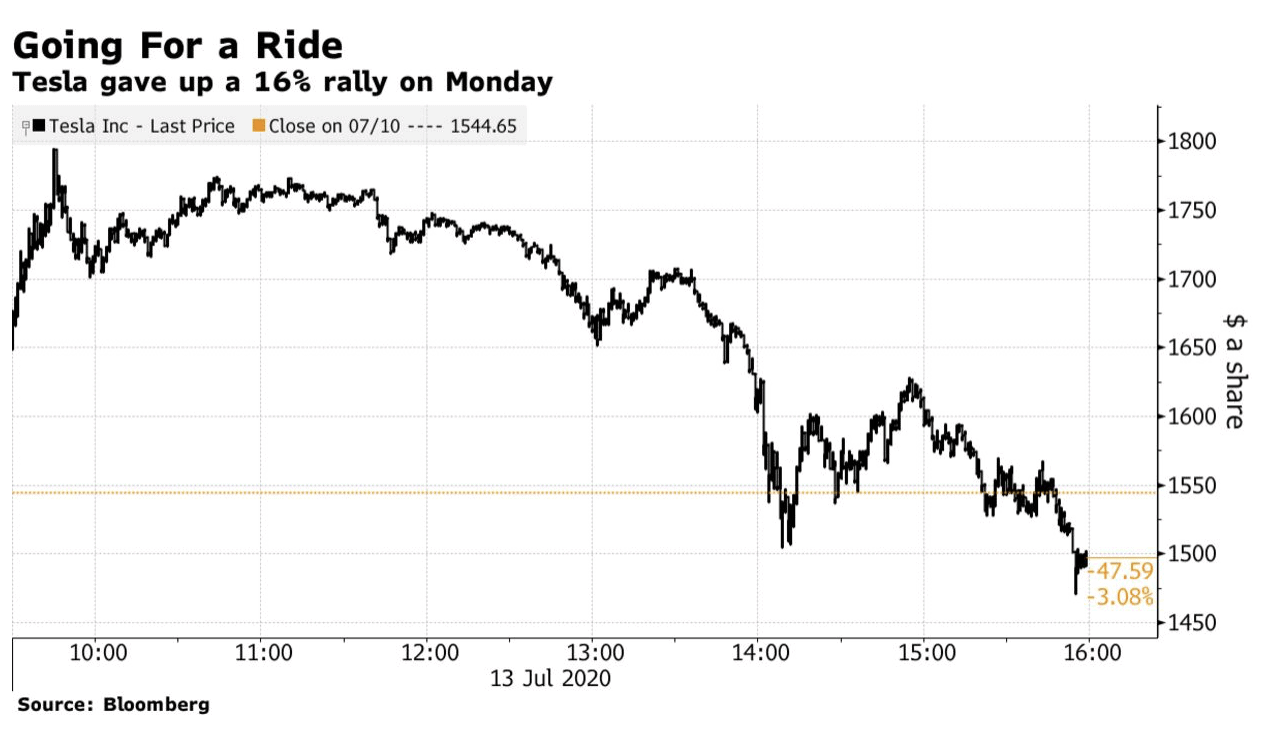

Tesla Motors stock spikes. Robinhood investors can't get enough of it. As 40,000 Robinhood account holders added TSLA to their portfolios, it's been a wild ride, to put it mildly. Up by 56% over the past 10 days (as of July 13, 2020), the market saw a 16% increase followed by a dramatic drop to 3% lower - all in one day.

This recent market cap grew by $202 billion. This development nudges Elon Musk's net worth up to $69.6 billion.

Here's what we reported way back in 2017:

Tesla Stock Begins Its Stratospheric Climb in 2017

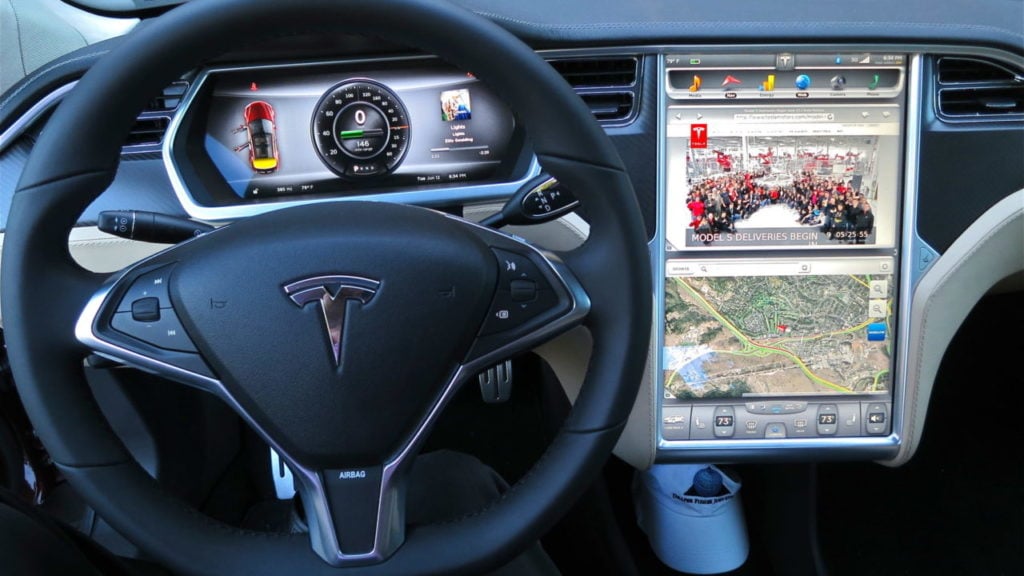

Tesla, the luxury electric car company is making inroads to the auto industry in light of its recent milestone as America’s most valuable car company. Despite Tesla Motors losing hundreds of millions of dollars in 2016 alone, the company’s shares have reached $51.5 billion.

Later this year, the company is set to release a new, mass-marketed electric vehicle named the Model 3. The release of the Model 3 is seen as a necessary expansion for the automaker that would otherwise limit itself to a niche market.

More Than Fast Cars

But part of Tesla CEO Elon Musk’s vision for the company is to make renewable energy affordable and attractive, and that may be a selling point for investors as well.

Tesla’s surging stock prices last week placed their overall worth above that of General Motors and Ford Motors, which are at $50.2 million and $44.6 million respectively. It was only back in 2013 when shares of Tesla’s stock sold for $40, and last week they reached $312.

However, Tesla didn’t do it alone. Friendly subsidies have at least in part provided fuel to the Tesla fire.

Not Everyone Is a Fan of Tesla Motors

Critics of Tesla have suggested that the manufacturer's production model is inefficient, and therefore doomed to tank. They purport that investors are naive to take a stake in a company that is on track to lose money again next year.

On the contrary, people do like to invest in growing companies – and that’s exactly what Tesla is doing. Tesla recently merged with SolarCity – an Elon Musk company that develops household batteries and cutting-edge rooftop solar panels – suggesting that Tesla has more in its future than just luxury electric automobiles.

Tesla Motors Greatest Asset

Musk, a high-profile entrepreneur and tech titan, may be seen as an even bigger asset for investors.

He was part of the original business advisory board to President Trump and met with the Administration again on last Tuesday. Although Musk has expressed his concerns about Trump, Musk said that he will work with him to move public policy forward.

The Takeaway

Here at Capitalism.com, we encourage entrepreneurs to create change in their world. A way oversimplified view of the path we travel is to build a business, invest the profits, and become financially free. Inside The One Percent community, we look at what's going on in the stock market, talk about investment strategies, and have all the lively discussions you would imagine happen when you find your tribe. We've also prepared a free video series you might really enjoy. You can find it here.

MORE BUSINESS NEWS STORIES ON CAPITALISM.COM:

These 10 Industries Are the Most Profitable for Small Business

How New Fintech Automation Software Has Replaced 360,000 Hours of Human Work

Why the Capitalism Initiative Investment Fund is Buying Impactful Brands