Destroying Debates with the Left on Taxation of High Income Earners

The left constantly talks about the “benefits” of increasing tax rates on highest incomes.

Today I’ll destroy this debate with one chart.

Reading this post will not only give you the tools to defeat most arguments in favor of higher tax rates but will expand your way of thinking. In the future, seeing through the intellectually dishonest tax rhetoric from any politician (right or left) will become far easier.

Let’s think about the so-called “arguments” we typically hear for higher tax rates on top incomes:

1. Spreads wealth more easily by taking money from people with more and giving it to people who have less. This gives the people with less, more mobility to become higher earners themselves. An example of this is the 1950s and 1960s, when the highest tax rates were extremely high (often approaching 90 percent) and income distribution was far more “equal.”

2. Reduces deficit and national debt. Because of higher taxes, the deficit goes down and we have a more balanced budget. A good example of this is the 1990s when former President Bill Clinton raised top rates to 39+ percent.

3. Allows government to spend more on education and social programs. This improves quality of life for all and increases our country's competitiveness and productivity.

4. Tax breaks for the rich by former presidents Reagan and Bush Jr. made our national debt sky rocket! We can’t afford that mistake again.

I could go on, but these are the usual suspects.

We all know the counter arguments and most of us can articulate them well. Unfortunately, it’s hard to make a convincing argument to persuade others because people on the left tend to be more emotional thinkers (don’t blame me, blame scientific studies.) Thinking emotionally leads one to believe in intentions rather than results.

Most would prefer a policy in which the intentions are good but had the opposite results, to no policy at all.

What’s great about using the following chart and explanation, instead of the canned responses we typically hear from worthless politicians on the right, is it breaks things down to a level of simplicity that cut’s through the emotional thinking.

One chart simply leaves a pro income tax hike person with no way to respond.

Drum roll please. What if tax rate increases didn’t produce more tax revenue? Every argument for raising the tax rate is void because the only reason to raise the rate is to increase revenue. Or is that the only reason?

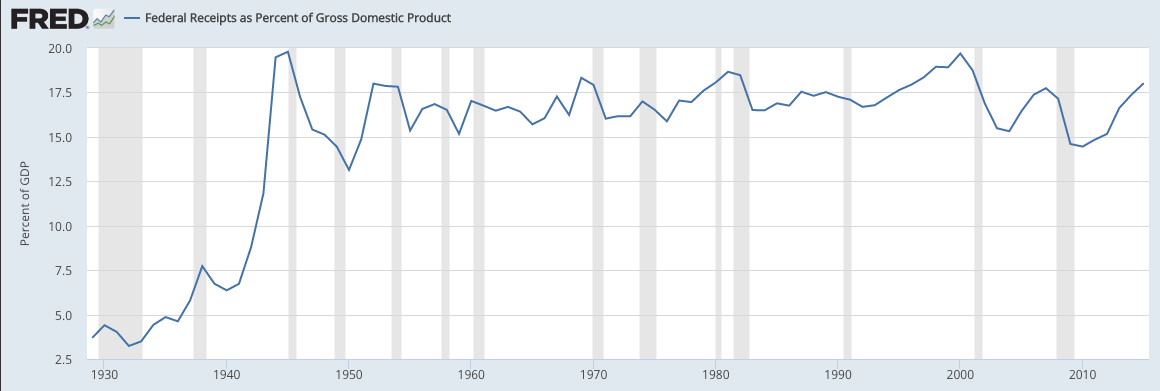

This is a chart of historic tax revenue as a percentage of GDP.

As we all know tax rates were as high as 90% in the 1950’s and as low as 28% in the 1980’s yet basically exact same tax revenue.

Obviously this immediately defeats any argument of a more equal distribution of income in the 1950s due to higher tax rates (or any benefit to higher tax rates of the past).

Next, it crushes any argument of Clinton balancing the budget because he raised top rate to 39.6 percent.

Why? Because former President Barack Obama raised it to the same rate and collected far less revenue as a percentage of GDP. This means there can’t be a causation affect between the raise to 39.6% and rise of tax revenues experienced in late 1990’s.

A higher tax rate doesn’t mean more spending on education and social programs. In order to spend more you have to get more (not to mention political will).

And finally, this chart makes it blatantly apparent the national debt increase during Reagan, and Bush Jr. had nothing to do with revenue, and everything to do with spending.

The government doesn’t have a revenue problem. It has a spending problem.

Actually, to be more accurate, the government didn't have a revenue problem. Now, the government does have a revenue problem (and a spending problem) because of past spending.

Why don’t tax revenues increase with tax rates? Honestly, I’m not sure.

Is it fewer loopholes with lower rates? Is it because people take more action to avoid paying taxes as rates go up? My guess is a combination of both.

Regardless, it doesn’t change the fact.

In order for a higher tax argument to have merit, using historical examples, higher tax rates would’ve had to produce higher tax revenue. Since this is empirically false, any argument for higher taxes has no merit.

So why would politicians so adamantly push for “higher taxes on the rich?” Because it makes them look good to their constituents.

"Democan" or "Republicrat" they know damn well tax revenue hasn’t changed much since the 1940s.

Like every word out of their mouths, it’s to manipulate those who don’t take the time to dig into the facts and think critically. #feelthebern

Remember this next time you hear an economist, politician, media talking head or emotional thinker, use historical taxation rates and revenues as though they’re synonymous.

RELATED:

• What Should Your Minimum Wage Be?

• FFLTV: Taxes, Haters and Equity Partners

• Tax Loopholes and Little Known-Strategies To Help You Invest Wisely