America has an extensive history of taxes. But did you know that income taxes weren't even a thing at the founding of the United States?

"In this world, nothing is certain except death and taxes." - Benjamin Franklin

That's right.

In today's political and social climate where taxes are a hot debate, there was a time when Uncle Sam wasn't sticking his fingers in our paychecks.

This article dives into the history of income tax — how it started, how it was unconstitutional, and how it became widely accepted.

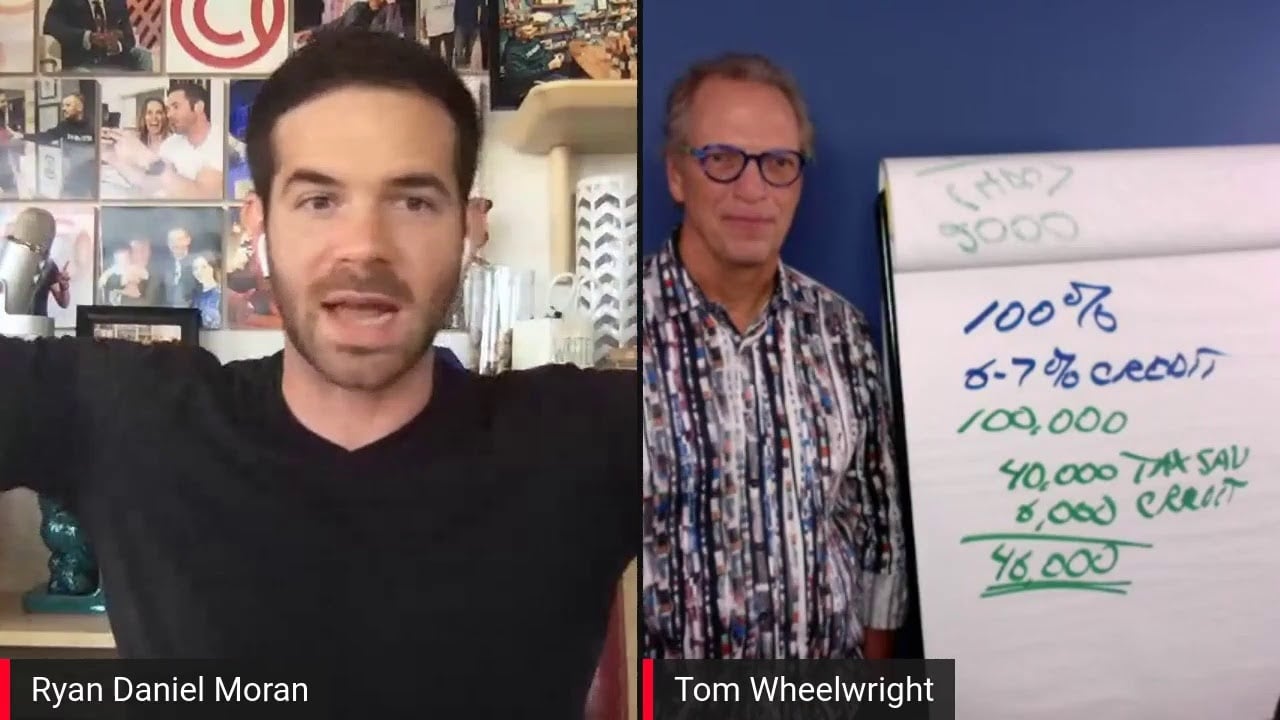

But first, if you want to know how to pay ZERO taxes, check out this conversation with Tom Wheelwright, the tax strategist featured in the Rich Dad, Poor Dad series.

The History of the Income Tax

Ready for a History Lesson in Income Taxes?

I hope you brought your pencils and notebook because this history lesson on income taxes comes to you from Capitalism.com. Let's get started.

When Taxes Were Just A Silly Dream…

Well, not really even a dream.

There just weren't any income taxes.

Our forefathers signed The Declaration of Independence in 1776. Several years after our country's founding, taxes were primarily tariffs, also known as import taxes, and excise taxes.

"Before the income tax, import taxes actually provided the largest share of the federal government's revenue stream," said Phillip W. Magness, a Senior Research Fellow at the American Institute for Economic Research.

But, at that time, the government was relatively small. It did not need to fund all the wars and social programs and debt interest that our growingly larger government has today.

There was no need for income taxes until the late 19th century.

America's First Income Tax

The Civil War started in 1861, and it was a necessary one. However, the war was expensive, and it was quickly draining the government coffers.

Lincoln needed an additional revenue source to fund the war efforts: income tax.

This would solve the war's funding issue and finally give the government the capital it needs.

And so, it came to be. Congress passed the Revenue Act of 1862 — the first federal income tax.

What Exactly is Income Tax?

Let's take a brief pause here in our history lesson.

First, what is an income tax?

As the term suggests, income tax is a tax the federal government levies on your income.

Right now, it may seem normal. But back then, income taxes were a big deal. In fact, income taxes were unconstitutional. The U.S. Constitution stated that the government was not allowed to levy direct taxes unless it met certain conditions (more on that later).

Now, back to our history lesson.

The First Income Tax Rates

The income tax required U.S. citizens to pay a percentage of their annual income to the federal government.

"This law required U.S. citizens to pay government taxes based on their yearly income. There was no tax on incomes under $600, but folks earning $601 to $10,000 paid 3 percent. The wealthiest people — those earning more than $10,000 per year — paid 5 percent," said Justin Cupler in Work+Money.

Within the following years, the highest income tax rate rose to 10 percent. Still, not too bad. We wouldn't see tax rates climb higher and higher… Right?

At first, it didn't.

Introducing the Flat Tax

Instead, the income tax rate lowered. The Civil War ended in 1865, and revenue wasn't as dire. This led to some people proposing a new tax structure: a flat-rate tax.

Congress passed a flat five percent income tax on all income over $1,000 per year. And wait, it gets better. The tax rate eventually lowered to 2.5 percent on all income over $1,000 per year.

But do you know what's better than small income taxes?

No income taxes.

Income Taxes Declared Unconstitutional

The deciding case was Charles Pollock v. Farmers Loan Trust Co. in 1895.

Charles Pollock was a stockholder in the Farmers Loan Trust and believed he should not pay a tax on his income. And the Constitution was on his side.

"Representatives and direct taxes shall be apportioned among the several states which may be included within this union." -U.S. Const. Art. I, § 3

What did this mean?

Ross Marchand of the Taxpayers Protection Alliance provides an example in Free the People:

"Let's say Virginia has 5 percent of the population. They can contribute to the federal government no more than 5 percent of its total revenue."

Therefore, a direct income tax violated the Constitution because it was not apportioned among the states.

And the Supreme Court agreed.

"A tax upon property holders in respect of their estates, whether real or personal, or of the income yielded by such estates, and the payment of which cannot be avoided, are direct taxes," said Chief Justice Melville Fuller.

After that, America enjoyed a mostly income-tax-free era from 1873 to 1912.

Of course, that didn't last.

Eat the Rich!

This Supreme Court decision wasn't popular — especially in today's political climate.

The case ruling emboldened the Populist Party, a left-wing movement that fought big money and big corporations. They wanted to take from the rich and give to the poor — redistribute the wealth, as today's democratic socialists call it.

Since income taxes weren't an option, they targeted the rich with inheritance taxes, corporate income taxes, and more.

But zero income taxes just didn't sit right with the people.

Not only did income taxes return, but it also became part of the U.S. Constitution!

Income Tax Enshrined as a Constitutional Amendment

That's right. In 1913, Congress overturned the 1895 Supreme Court ruling with the 16th amendment's ratification:

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

How convenient.

From 1913 and on, Uncle Sam had the power to dip his fingers in our paychecks.

Still Eating the Rich

At first, the income tax following the 16th amendment's ratification was mild — only 1 percent of the population paid income taxes and only 1 percent of their net income.

But slowly, the number of income tax brackets increased alongside the amount the government taxed. The government started taxing not only the rich but also across several income brackets.

It didn't reach sky-high numbers until Congress passed the War Revenue Act in 1917 in response to World War I. Taxes rose as high as 67 percent on the highest tax bracket.

Fast Forward to Today

Throughout the years, income taxes tax rates have risen and fallen with each president's administration. The tax brackets also have increased — at one point to over 50 — and decreased.

Of course, this led to a growingly complex tax code. The Tax Foundation once even estimated the tax code as long as 70,000 pages.

But what does income taxes look like today?

Well, President Donald Trump signed the Tax Cuts and Jobs Act (TCJA) on December 22, 2017, which reduced individual income and corporate tax rates. Also, it created the qualified business income (QBI) deduction, which allows certain self-employed entities to claim a 20 percent deduction on qualified business income.

While this simplifies matters, Trump's tax plan creates savings that allow new and existing entrepreneurs to start, grow, and expand their businesses.

And what about COVID-19? Trump rolled out the COVID-19 Tax Relief Plan, which aims to support entrepreneurs and small business owners during these crazy times. Read more about it here.

Now, Let's Talk About Your Income Tax

What Is An Example Of Income Tax?

Income taxes are taxes that the government imposes on income that businesses and individuals generate. There are several types of income taxes, including:

- Personal (e.g., wages and salaries)

- Business-related (e.g., sales-generated revenue)

- Property (e.g., rental income)

- Investment (e.g., capital gains)

The government uses your taxes to fund various social programs, public services, or — during President Lincoln's presidency — to fund a war to abolish the cruel institution of slavery.

How Is Income Tax Calculated?

The United States has a progressive income tax plan, and many people might misunderstand what that means.

Many think that you find your tax bracket (e.g., $40,125 to $85,525), and that's the tax rate you pay.

However, the tax rate actually only applies to income within that tax bracket.

Income Taxes Example

To illustrate, let’s look at an income tax example. We’ll be using this hypothetical progress tax plan for simplicity:

- $0 to $9,999: 10%

- $10,000 to $19,999: 15%

- $20,000 to $29,999: 20%

Let's say you made $30,000 during that tax year. Here's how your individual income tax would break down to cover every dollar you make from:

- $0 to $9,999 gets taxed at 10%

- $10,000 to $19,999 gets taxed at 15%

- $20,000 to $29,999 gets taxed at 20%

Many people believe that the total amount you make indicates how much tax you pay on your income. Instead, various tax brackets determine what you pay on portions of your income.

What Do I Do If I Am Paying Too Much Tax?

If you receive an income tax refund from the US government for several thousands of dollars after filing your taxes, you've paid too much in taxes.

While a large check sounds great, think about it this way. You're essentially giving the government an interest-free loan.

Imagine what you could do with that money if you invested it in the stock markets or used it to start your business?

The quickest solution to overpaying on taxes (and putting more money in your pocket each month) is to adjust your employee Form W-4. By adjusting your allowances, you can increase or decrease how much money your employer withholds from your paycheck.

Remember: you can claim withholding allowances for yourself, your spouse, and each of your dependents. You may even want to use an income tax calculator to determine how much of your paycheck you want to withhold.

How Can I Reduce My Income Tax?

If you're smart about filing your taxes, you can keep more money in your pocket if you learn how to reduce your taxable income. Some tips for keeping Uncle Sam away from your hard-earned money include:

- Retirement Funds: If you have a 401(k) account through your employer, the IRA does not tax the money you allocate from your paycheck. Also, it is possible to deduct contributions if you have a traditional IRA.

- Business Deductions: There are several business expenses that you can deduct to reduce your taxable income. Some include your home office, self-employment, internet and phone bills, and even your health insurance premiums.

- Qualified Business Income (QBI) Deduction: Also called the 199A deduction, the 2017 Tax Cuts and Jobs enables non-corporate taxpayers to deduct 20 percent of your income. The QBI deduction is significant and is worth researching if you're a small business owner.

- Charity: Your charity donations can actually lower your tax bill. Just be sure to save all your receipts.

Of course, this is only a start. We recommend consulting a financial professional to explore all tax-saving opportunities.

Taxes Won't Stop the Entrepreneurs

The journey of income taxes shifting from unconstitutional to constitutional is a fascinating one. Yet, no matter how much the greed of our federal government increases, entrepreneurship always thrives. The innovation and creativity of entrepreneurial minds — not government taxation and spending — is what drives countries forward.

It’s the entrepreneur who creates positive change in the world. That’s why we focus on supporting YOU in starting your own business, growing it, and investing the profits so you can live a life of true liberty. That’s also why we created this free training for people who are ready to take their first steps on their entrepreneurial journey.